Steps of the Accounting Cycle

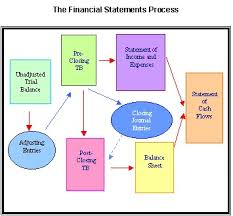

Following the Steps of the Accounting Cycle ensures staying in balance and the post closing trial balance is correct.

Following the Steps of the Accounting Cycle ensures staying in balance and the post closing trial balance is correct.

Collecting and verifying source documents is important because a business needs to know how and why business transactions occurred. With an invoice,receipt, memorandum, and check stub, the business knows exactly where the money is coming and going.

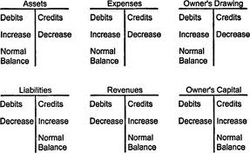

To analyze each transaction, debits and credits are taken into account. A description is given with each transaction in the source documents.

A journal is a record of the transactions of a business. To Journalize is to record the business transactions in the journal.

The general ledger is a permanent record that is organized by the account number of each account in the business. When posting to the ledger, the account name, the date of the transaction, a description of the transaction, whether the account is debited or credited, and the amount debited or credited is written in the columns.

Preparing a trial balance is sometimes known as "proving the ledger". A trial balance is a list of all of the account names and their balances.

If the accounts add up to the same amounts, the trial balance is in balance. If the accounts do not add up, there is an error in the journal, the posting process, or in the preparing of the trial balance.

If the accounts add up to the same amounts, the trial balance is in balance. If the accounts do not add up, there is an error in the journal, the posting process, or in the preparing of the trial balance.

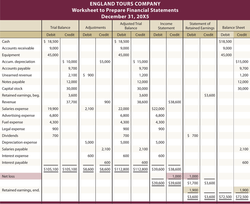

A working paper used to collect information from the ledger accounts in one place.

- The worksheet is prepared by first writing the heading: who, what, and when.

- Then, the account name and number are written in the first two columns.

- In the second set of columns, the amount in the trial balance is debited or credited and then again in the income statement section.

- After all of this is completed, it is then balanced in the last two columns.

The four financial statements are the income statement, the balance sheet, the statements of the changes in owner's equity, and the statement of the cash flows. Each of these statements are prepared to analyze the health of the business

The Closing Entries close the balances to transfer the net income to the capital account. These are calculated then posted

prepare a post closing trial balance.. this is done so that the business can make sure that the amount of debits equals the amount of credits.